They can't breathe? Heavy knee of regulation on their necks?

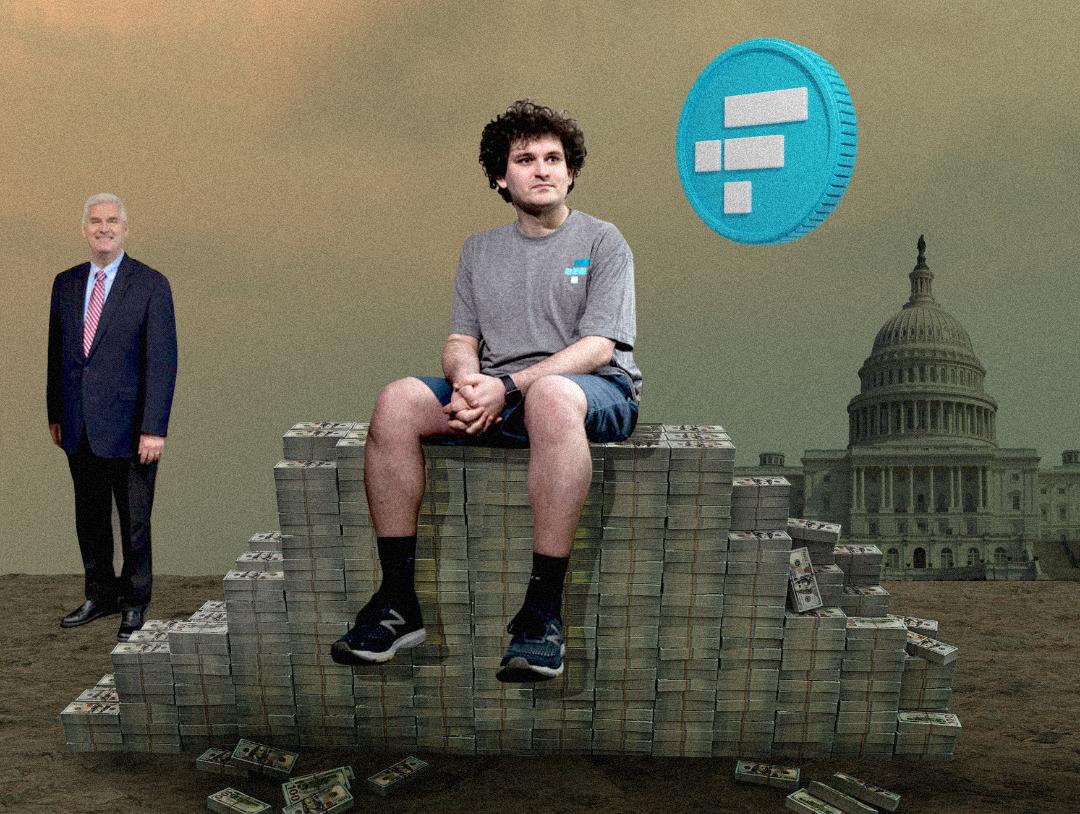

Now, from one perhaps more a cynic - skeptic than Crabgrass, there is J'accuse, with a suggestive lead photo:

|

| Link. No quote. It is there to read. And to ponder. |

While that linked op-ed speculates a bit, it does post a link to a letter, this one, three pages long, by image, note the date, before the fan loaded up:

|

| click each image to enlarge and read |

LEAD LETTER AUTHOR: My rep, MN CD6, Tom Emmer, preceeded in office by Michele Bachmann, (but don't blame me), I've voted Dem. all along, but majority rules, however enlightened or ignorant.

That letter indicated Lizzy Fallon as contact person for the esteemed authors.

Lizzy Fallon serves as a Financial Services Policy Advisor in the United States House of Representatives, leading the Representative’s Financial Services Committee portfolio, and specializing in policy related to fintech and blockchain/crypto. Additionally, Lizzy manages the Member’s co-chair responsibilities on the Blockchain Caucus.

Not an academic finance heavyweight, Fallon holds only a baccalaureate degree attained 2017, and prior to landing on FinServices staff was -

It is unclear who, if anyone, had any crypto/financial market expertise on the FinServices Committee staff (something that did not stop reps from favoring donor folks in the trade).Research Associate - Parkhurst Energy

May 2020 - Oct 2020 6 months

Houston, Texas, United State

GraphicSpecial Projects Intern -

The [Trump] White House

May 2019 - Aug 2019 4 months

..................................................

The post with the above crypto image of Rep. Emmer and an industry insider has very useful and informative recent links. Check them out.

However, to even better understand today, look to a recent yesterday apart from that DWT item, from before crypto tanked, from the spring of this year, where it had cheerleaders, enablers, advocates, congress critters:

The Skadden Arps lawfirm, possibly having skin in the game, on March 25, 2022, published:

Congressional Blockchain Caucus Challenges SEC Chairman on Web3 Enforcement

The Web3 community has long expressed frustration at the lack of clarity emanating from the SEC regarding the treatment of cryptocurrencies and other digital assets under current securities laws, with many characterizing the agency’s activities as “regulation by enforcement.” The community now has an important ally in the so-called Congressional Blockchain Caucus, a bipartisan group of approximately 35 Congress members who describe themselves as those “who believe in the future of blockchain technology, and understand that Congress has a role to play in its development. As a Caucus, we have decided on a light touch regulatory approach.”

On March 16, 2022, Rep. Tom Emmer (R-MN) and seven other Congressional Blockchain Caucus members sent a letter to SEC Chairman Gary Gensler questioning the commission’s use of the Division of Enforcement and Division of Examination to obtain information related to “cryptocurrency and blockchain firms.” Specifically, the members assert that the SEC has been using the Enforcement Division’s investigative functions to gather information from cryptocurrency and blockchain companies in a manner inconsistent with the commission’s standards for initiating investigations and “at odds with” the Paperwork Reduction Act (PRA). The PRA, which was enacted in 1980, imposes certain approval requirements on government agencies seeking to obtain information from the public in order to minimize the burden on those from whom information is sought. In order to better understand the SEC’s authority to secure the information it seeks from blockchain firms — and to ensure these requests “are not over-burdensome, unnecessary, and do not stifle innovation” — the letter poses 13 questions to the SEC that center around the SEC’s activities in this space over the last five years.Key Takeaway

Over the past year, certain Congress members have expressed

frustration with [SEC] Chairman Gensler’s approach to cryptocurrency,

voicing concerns that it may stifle innovation and prevent the U.S.

from being the global market leader in this area. While legislation

to address how cryptocurrencies and digital assets fit within the

federal securities laws’ framework is likely not on the short-term horizon, reliance on the PRA could provide an interesting angle by Congress to act as a check on the SEC’s efforts to collect information in this space.

[italics added] The gall of it. "As a Caucus, we have decided on a light touch regulatory approach.” Indeed. Not wanting to impede the new thing shaking things out expeditiously, free of red tape. It turned out to be unsolicited effort toward paying out rope for the perps to hang themselves.

BUT - Donor perps, and that matters.

NOTE - All the regularors were doing is keeping an eye on things, and that to Mr. Emmer and other Blockchain Caucus advocates was too much of a burden? Get real.

Fortune, March 18, 2022 -

“Crypto startups must not be weighed down by extra-jurisdictional and burdensome reporting requirements,” Emmer wrote in a statement on his congressional website. “The SEC must ensure that its information-seeking requests to private crypto and blockchain firms are not overburdensome, unnecessary, and do not stifle innovation.”

The struggle between Emmer and his cosigners and the SEC boils down to how much control the agency has over private crypto companies. Emmer argues that although the SEC is able to request the voluntary interviews, testimonies, and the production of documents from entities it regulates, it is overreaching in its power. He also argues that the regulatory agency is applying this power to companies and entities not under its jurisdiction.

What is the Congressional Blockchain Caucus?

The Blockchain Caucus was founded during the 2015–16 session of Congress. It currently includes four chairs and 33 members from both parties, according to its website.

The U.S. Congress has more than 400 caucuses, or groups of members of Congress with a common legislative objective. The Blockchain Caucus advocates for “a light touch” regulatory approach to blockchain technology like cryptocurrencies and NFTs.

Because of the Blockchain Caucus’s preference for light regulation, its members have sometimes clashed with the SEC, whose chair, Gensler, has characterized crypto markets as the “Wild West.”

In their most recent spat, several members of the caucus—though, not all—argued that two forms the SEC sends to crypto companies, Form 2866 and Form 1662, ask for much of the same information, which is burdensome to companies. Form 2866 asks crypto companies to send information like verification of their assets and an assessment of their company’s risks, and Form 1662 lays out the penalties for not disclosing these details.

Gee. Verification of assets. As in don't blow smoke. And risk assessment. Of all things. Selling investment opportunities, and being requested about such things, to Emmer it is unnecessary burden.

Can you imagine a greater burden? Apparently Emmer cannot. Nor, apparently can he see justification for such investor-friendly inquisition. Fraud prevention? Never enters his mind? More from Fortune -

Emmer wrote in the letter that under the Paperwork Reduction Act of 1980, government agencies, when seeking information from the American public, “must be good stewards of the public’s time, and not overwhelm them with unnecessary or duplicative requests for information.”

[...] Under Gensler, the SEC has said little about blanket regulations for crypto and NFTs. Yet Gensler has made it clear that he has his eyes set on the industry. The SEC chair said earlier this year that he hopes the regulatory agency will start regulating cryptocurrency exchanges in 2022. Last week, President Biden’s executive order on crypto directed several federal agencies to study the drawbacks and benefits of crypto, possibly opening the door for new regulations.

Emmer said in a tweet that he has heard from many crypto and blockchain firms that

“SEC Chair @GaryGensler’s information reporting ‘requests’ to the crypto community are overburdensome, don’t feel particularly…voluntary…and are stifling innovation.”

Stifling innovative fraud might actually be sound government policy. And there is 20/20 hindsight.

Readers might learn more about the Blockchain Caucus, per this web search.

Noteworthy to be sure, via one of the hits from that search, we see congress critters can have some really bad ideas, authoritarian patriarchial anti-privacy ideas to undermine the very grounding of blockchain/crypto appeal and trust. Show sense. Being in Congress and showing sense are not wholly inimical, only too often alien to each other.

Back to the opening for a closing note. Somebody should try to untangle and publish about the follow the money thicket between the crypto promoters, their payments into politicians' campaigns, and the efforts of elected officials and paid political campaign folks to subsequently serve the desires of the donors, not biting the hand that feeds their lust for office and power. The DWT item linked to in opening this post alludes to Emmer as being too grateful for crypto campaign funds; but does not really document any such tie-in. We must be careful to not mischaracterise things.

So -

In effect, back to Emmer, and his hands on money as having been RNCC top dog this past election. What can crypto buy is a multifaceted question. It appears that donors pay real bucks to gain influence, not bit coin, but legal tender.

Yet without hard facts on dark money, we can only speculate; thanks to politics.

Thanks to Citizens United, decided as it was. Thanks to money and politics being of mixed concern to politicians. Regular Citizens are not conflicted that way.

Now, wholly unrelated to Blockchain Caucus, crypto promoters, crypto enablers, political contributions, and claims of over-regulation bordering perhaps (implicitly but unstatedly so) as unmitigated pure harassment of exemplary people. Simply unrelated to any of the preceding. From the 40's, before crypto existed - a tune.

Most likely a Quixotic tune. But catchy. In its own way easy to sing along.

_________UPDATE_________

Emmer on YouTube, about crypto, here, and interestingly here, the latter being interaction with a Financial Services Committee witness which is relevant today.

Both are about from a year ago, not today. The second video was embedded by Emmer into a tweet about "extensive guardrails" some crypto actors embrace. The tweet was noted by the Atlantic, in closing.

More Emmer, Breitbart and Minnesota Reformer.

OpenSecrets - see especially, items 6 and 15:

Contributors 2021 - 2022

$1,427,938

grand total of contributions Tom Emmer has reported in the current election cycle.

Number of Contributions from Individuals (of $200 or more): 1,322Top:

Rank Contributor Total Individuals PACs 1 Votesane PAC $106,000 $106,000 $0 2 Leamington Co $22,600 $22,600 $0 3 Hubbard Broadcasting $17,915 $17,915 $0 4 Timberland Transportation $17,400 $17,400 $0 5 Xcel Energy $16,250 $6,250 $10,000 6 Digital Currency Group $15,513 $15,513 $0 7 Starkey Hearing Technologies $14,000 $14,000 $0 8 National Assn of Broadcasters $12,650 $7,650 $5,000 9 Polaris Inc $12,000 $6,000 $6,000 10 King Capital Corp $11,600 $11,600 $0 11 Red Wing Publishing $11,600 $11,600 $0 12 Element Electronics $11,600 $11,600 $0 13 Dart Transit $11,600 $11,600 $0 14 Forward Financing $11,600 $11,600 $0 15 FTX.US $11,600 $11,600 $0 16 Anderson Trucking Service $11,600 $11,600 $0 17 Andreessen Horowitz $11,600 $11,600 $0 18 Arvig Enterprises $11,600 $11,600 $0 19 Affiliated Managers Group $11,600 $11,600 $0 20 UBS AG $11,000 $1,000 $10,000 *registrants, or active lobbying firm

These tables list the top donors to candidates in the 2021 - 2022 election cycle. The organizations themselves did not donate, rather the money came from the organizations' PACs, their individual members or employees or owners, and those individuals' immediate families. Organization totals include subsidiaries and affiliates.

No proof of any quid-pro-quo has been found online. Emmer has larger donors than either of the crypto items. Circumstances can be viewed multiple ways, but Emmer is a big crypto booster, that is a fact, and one donor is now in hot water. How those two facts are read together should be leavened by an expectation of propriety.

Compare an earlier cycle's Emmer donors.

...............................................

The American Prospect IS a partisan site, not generally favorable to Republicans.

That said, this item dated Nov. 23, 2022, reports:

The Securities and Exchange Commission was seeking information from collapsed cryptocurrency exchange FTX earlier this year, the Prospect has confirmed, bringing a new perspective to an effort by a bipartisan group of congressmembers to slow down that investigation.

The March letter from eight House members—four Democrats and four Republicans—questioned the SEC’s authority to make informal inquiries to crypto and blockchain companies, and intimated that the requests violated federal law.

Rep. Tom Emmer (R-MN), whom the Republican caucus just elected as majority whip, the number three position in the House GOP leadership, led the letter. In a contemporaneous Twitter thread, Emmer wrote: “My office has received numerous tips from crypto and blockchain firms that SEC Chair @GaryGensler’s information reporting ‘requests’ to the crypto community are overburdensome, don’t feel particularly … voluntary … and are stifling innovation.”

We now know that FTX was one of those firms receiving information requests from the SEC, about the very activities that have brought down the firm. This raises the question of whether Emmer and the other congressmembers were acting on behalf of FTX (which has been credibly accused of snatching customer money to make risky bets) to try to chill an ongoing investigation from an independent regulatory and law enforcement agency.

[italics added] Note the posing of a question, and not an expression of probability. Same item, continuing -

Some of the “Blockchain Eight,” as the Prospect termed them in March, have benefited from crypto largesse. Five of the eight members received campaign donations from FTX employees, ranging from $2,900 to $11,600. Rep. Ted Budd (R-NC), one of the signatories, received half a million dollars in support from a Super PAC created by FTX co-CEO Ryan Salame.

More consequentially, Emmer was the head of the National Republican Congressional Committee, the campaign arm for House Republicans, this year. The NRCC’s associated super PAC, the Congressional Leadership Fund, received $2.75 million from FTX in the 2022 cycle; $2 million from Salame in late September, and $750,000 from the company’s political action committee.

That money helped House Republicans win the majority in 2022. Though FTX has been portrayed as a Democratic firm, thanks to the high profile of former co-CEO Sam Bankman-Fried, the company sprinkled around campaign donations fairly evenly, with a shade over 50 percent going directly to congressional Republicans and a shade under 50 percent to Democrats this cycle.

In an email, the SEC declined to comment. Six of the eight congressmembers have yet to respond to the Prospect’s inquiries.

[...] REUTERS REPORTED LAST FRIDAY on an internal FTX document, showing that the SEC had made informal inquiries earlier this year to FTX and other firms about how they handled customer deposits. As we now know, FTX was funneling customer funds to its associated trading firm Alameda Research. The newly installed CEO of FTX, John Ray, told a bankruptcy court last week about a “complete lack of corporate controls” at the company.

The SEC also asked FTX about a rewards program that gave depositors interest on their crypto assets, which could make them a security. SEC chair Gary Gensler has been adamant that crypto platforms are trading and minting securities, and that these securities needed to be registered with the agency. Crypto firms have generally failed to register anything.

In response to the inquiry, FTX asserted that the rewards program did not involve any lending and was aboveboard. The SEC then replied that it did not need further information “at this time.”

Timing of such FTX and SEC activity, re the timing of the Emmer - Blockchain Eight letter would be of interest, but timing of the SEC - FTX dealings could not be pinned down. More from the American Prospect item:

Emmer made clear in his March Twitter thread that the letter was based on complaints from crypto firms, and that his intent was to stop the SEC from making these inquiries. “Crypto startups must not be weighed down by extra-jurisdictional and burdensome reporting requirements,” Emmer wrote. “We will ensure our regulators do not kill American innovation and opportunities.”

On the flip side, Emmer was quick to laud Bankman-Fried for his integrity and compliance with the law. In December 2021, Bankman-Fried testified before Congress, and Emmer told him, “Sounds like you’re doing a lot to make sure there is no fraud or other manipulation.”

Emmer and Gottheimer led the Blockchain Eight in donations from FTX with each receiving $11,600. FTX was in the top 15 of Emmer’s biggest donors in the 2022 cycle. Auchincloss received $6,800, and Budd and Torres received $2,900.

Coinbase has also contributed to members of the Blockchain Eight. Emmer received $2,900 from Coinbase’s PAC in 2022; Gottheimer got $2,900 from a Coinbase employee, and Auchincloss got $2,000.

Budd was the beneficiary of roughly $517,000 in spending from co-CEO Salame’s Super PAC, American Dream Federal Action.

But the millions in funds from FTX’s PAC and Salame to the House Republicans’ Congressional Leadership Fund dwarf the spending to individual candidates. As the lead signatory of the letter and the member who said he’d received “tips” from crypto firms that informed that letter, and as the head of House Republicans’ campaign arm, Emmer had the most to gain from a large donation to help the GOP win the majority. “We delivered,” Emmer said after the majority was secured.

Salame gave $23.6 million to exclusively Republican candidates and causes in the 2022 cycle, in contrast to Bankman-Fried, whose $40 million went to Democrats. A handful of members, including Reps. Chuy García (D-IL) and Kevin Hern (R-OK), have returned FTX donations, and Sens. Dick Durbin (D-IL) and Kirsten Gillibrand (D-NY) have donated the contributions to charity. None of the Blockchain Eight have yet said what they would do with their own FTX donations.

The catastrophe at FTX hasn’t stopped Emmer from continuing to boost crypto.

THE UNORTHODOX LETTER IS ANALOGOUS to the 1987 “Keating Five” scandal. Then, five senators (including a young Arizona Republican named John McCain) pressured the Federal Home Loan Bank Board (FHLBB) into shutting down an investigation into Lincoln Savings and Loan and its chair Charles Keating Jr. Keating was a donor to all five senators, giving $1.3 million over the years.

There is a bit more, but comparing the Emmer situation to the Keating Six and the S&L failure is speculative, and suggestive. At present it is premature conjecture.

__________FURTHER UPDATE__________

Emmer campaign page,

https://emmerforcongress.com/donate-with-crypto/

indicates donor intent to contribute in cryptocurrency would be accepted.

Another campaign page,

states:

Emmer Leads First Cryptocurrency Town Hall, Accepts Crypto Contributions

For Immediate Release

August 20, 2020

Contact: Zach Freimark (612) 804-1771

press@emmerforcongress.com[...]

Congressman Emmer partnered with the Chamber of Digital Commerce PAC to facilitate the town hall and featured leaders from the blockchain & crypto industry, including Jeremy Allaire, CEO of Circle, Brad Garlinghouse, CEO of Ripple, Guy Hirsch, USA Managing Director at eToro, Stephen Pair, CEO of BitPay, Matthew Roszak, Chairman and Co-Founder of Bloq, and Chad Cascarilla, CEO and Co-founder of Paxos.

https://www.linkedin.com/in/zachary-freimark-60640111 - identifies Freimark as

Experience

![NRCC Graphic]()

Regional Political Director

NRCC

Senior Advisor

Emmer for Congress

District Representative

Congressman Tom Emmer

Political Director

Mike McFadden for Senate

Consultant

Scott Honour for Governor

Consultant

Emmer for Congress

Senior Account Manager

Civis Communications

![Republican Party of Minnesota Graphic]()

Political Director

Republican Party of Minnesota

Political Director

Roy Brown for Governor

Deputy Campaign Manager/Director of Field Operations

Brian Davis for Congress

Volunteer Coordinator

Jim Ramstad Volunteer Committee

Education

- University of Minnesota

University of Minnesota

B.A.Political Science, History

- University of Minnesota

University of Minnesota

Political SciencePre-Law Studies

This suggests a political operative, not an economics heavyweight, where the expectation is that Freimark is not the driving force behind Emmer's understandings of cryptocurrency value, trading, market, and credability.

That in turn suggests Emmer's reliance in and promotion of crypto has another base than Freimark, presumably the host of Townhall participants above named, and the Chamber of Digital Commerce PAC, above named.

Reliance upon market participants carries a bias, if that is how Emmer relied.

It seems incumbent upon Emmer, now in today's realities, to explain what he and the witness are saying in the video (posted first online by Emmer) now placed onto the sidebar. As best as Crabgrass understands it, Emmer is complaining that crypto exchanges are under SEC scrutiny, denial, or discrediting while derivatives on crypto are SEC-allowed to be traded, presumably by conventional derivative trading houses.

If that is incorrect, we hope Emmer will be enlarging and revising his video remarks in the near future for clarity, i.e., to make clear to regular people why he is so avid a crypto promoter. And not in easy generalities, touting the next big thing, but how in detail he sees investor reliance in crypto a sound thing. He should identify his advisors on the technicalities of what he is promoting. Else, conclusions can range into areas Emmer might want to disarm.

Of those Townhall participants, readers, have you ever heard of any or have any idea of professional credibility any one of them holds among economists and bankers? Yes, crypto is a challenge to central banking and central bankers, and to banks happily under the Fed's umbrella while they run the Fed, but that does not gut nor bolster crypto credibility.

In effect: What's the story, Tom? Spell out a host of detail, please? Make it hang together and make sense to ordinary minds, and to lawyers who might wonder.

Something beyond a puff-piece in Breitbart, please.

|

| click image to enlarge and read |

That Breitbart item continues beyond the screen capture:

As the Fed failed to curb inflation, it has moved to hike interest rates to fight back against decades-high inflation.

To aid cryptocurrencies’ mission to serve as a counterbalance to mismanaged monetary policy, Emmer said the federal government could provide a more clear regulatory environment and ensure that Securities and Exchange Commission (SEC) chairman Gary Gensler does not have “rogue authority” to regulate the burgeoning crypto industry.

Emmer said, “In order for us to start to move forward on this you have to at least start to define what is cash? What is a commodity, what is a security? It makes, frankly, securities lawyers rich. They like to go when we got the Howey Test. The Howey Test was created during a time when digital currencies weren’t even a thing. I think it’s time to define those terms.”

The Howey Test refers to the U.S. Supreme Court case for determining whether a transaction amounts to an “investment contract” and would be a security and thus subject to disclosure and registration requirements under the SEC.

The Howey Test is an important issue in the digital currency community, as many digital currencies and blockchain technologies such as Ethereum may qualify as a security, and thus fall under Gensler’s regulatory purview.

The Minnesota Republican sponsored the Securities Clarity Act to help innovation flourish by clarifying that a digital currency token is separate and distinct from a traditional security.

Emmer continued, “I don’t believe in creating another regulatory or regulator and other regulatory agency. I think we can do it within the ones we already have. But we have to start defining them so we know that Gary Gensler does not have rogue authority over every aspect of the crypto community. I think that would be first and foremost from a general statement, what we’d need to do.”

Emmer, a member of the Congressional Blockchain Caucus, sponsored many bills to provide a more clear regulatory approach and to prevent stifling innovation in the financial technology sphere. This includes:

- H.R. 6415, which would prohibit Federal Reserve banks from offering central bank digital currencies (CBDCs), which many argue would grant nearly totalitarian levels of control over Americans’ money

- The Blockchain Regulatory Certainty Act, which would provide regulatory clarity to blockchain innovators.

Emmer also said that Republicans, if they take the House majority during the congressional midterms, would hold members of the Biden administration accountable, such as Gensler, Consumer Financial Protection Bureau (CFPB) Director Rohit Chopra, and Treasury Secretary Janet Yellen.

“These people think they’re above the law, above Congress’s supervision, and they’re not,” Emmer said. He said the Biden administration remains hostile to crypto despite the potential it has for the country and the world.

Emmer said, “This administration is not just the guy at the top, but the administration is littered with people who I would argue are not favorable towards the crypto space in frankly, the promise that it holds in terms of opportunity for all Americans and people around the world.”

Does this "exposition" pass your credibility litmus test, where admittedly the Fed and monetary policy can be criticized? How does crypto make things more stable and less cyclical, when co-existing with the Fed, and beyond current players not wanting competition, why would the Fed issuing its own crypto be a bad (or good) thing? Right now we have crypto, decentralized - spun off in different "token" batches by private sector promoters, as "money" but does it carry the trust that a fiat currency must have, such as the dollar or treasuary bonds?

I don't know. Do your know? Does Tom Emmer know? Does Tom Emmer really care beyond crypto folks funding campaigns? Only Tom Emmer knows the answer to that last one.

Emmer appears to have made statements - bald assertions - without any bases in truth or logic offered to justify or underpin what he says.

Do you understand why any prudent person should invest in and rely on crypto?

Why crypto trading is anything beyond a casino with insiders who Townhall us along with Emmer, while you have never heard of them and have no real cause offered to trust their product?

___________FURTHER UPDATE___________

To the extent context might help readers focus upon the Emmer questioning aimed specifically at FTX, the hearing from which that segment was excerpted and posted by Rep. Emmer is online here, two and a quarter hours, and the Emmer interchange is at roughly the 54 and a half minute mark. The item seems to start without an identification of witnesses, etc., but mid hearing.

From following the entire process it is easier to understand the committee members each had particular focused attention toward one or another specific aspect of crypto/blockchain and the distributed vs. centralized nature of the process, as well as other dimensions. With five minutes per member, nobody could range too widely in attention and inquiry. Emmer seemed focused upon price discovery, in derivative trading. The reliability of it. Other Reps. during their time looked at Blockchain apart from crypto usage, and the caucus is "The Blockchain Caucus," not specifically focused upon crypto, which is the major Blockchain application domain at present.

A much wider range of utilization of Blockchain has been noted as feasible, and arguably desirable, with its uniqueness. Crabgrass is not yet versed in the nuances and potential, not owning or following crypto until reading the DWT item critical of Rep. Emmer. Keeping an open mind because of such ignorance of the topic is necessary, and an effort is being made to "study up" to gain a better understanding. E.g., online hearings touch policy and regulatory possibilities or needs, while this link might start a reader on technical discovery.

[UPDATE - As one example, one Rep. noted how crypto might allow prompt low cost sending of money by a worker stateside to family in another nation without the cost, delay, and impediments of using banking intermediation to handle such transfers. Clearly a different focus than Emmer's in that questioning segment. Emmer however has otherwise touted crypto as an empowering thing for low end folks in the economy, and such sending aid back home fits Emmer's general remarks in that direction.]

FURTHER: Ars Tech. indicates Bankman-Fried may likely be testifying before a House Committee, with possibly a Senate hearing too, both later this month. Rep. Emmer would likely be questioning him again, if the anticipated House hearing actually comes to pass. Moreover -

Websearch = Bankman-Fried testifying this month congress

The likelihood of such upcoming testimony is widely reported.

.....................................

Those interested in blockchain, an easy non-tech online item, here. Enthusiastic. Dated.

More recent, last month, here, make of it what you will.